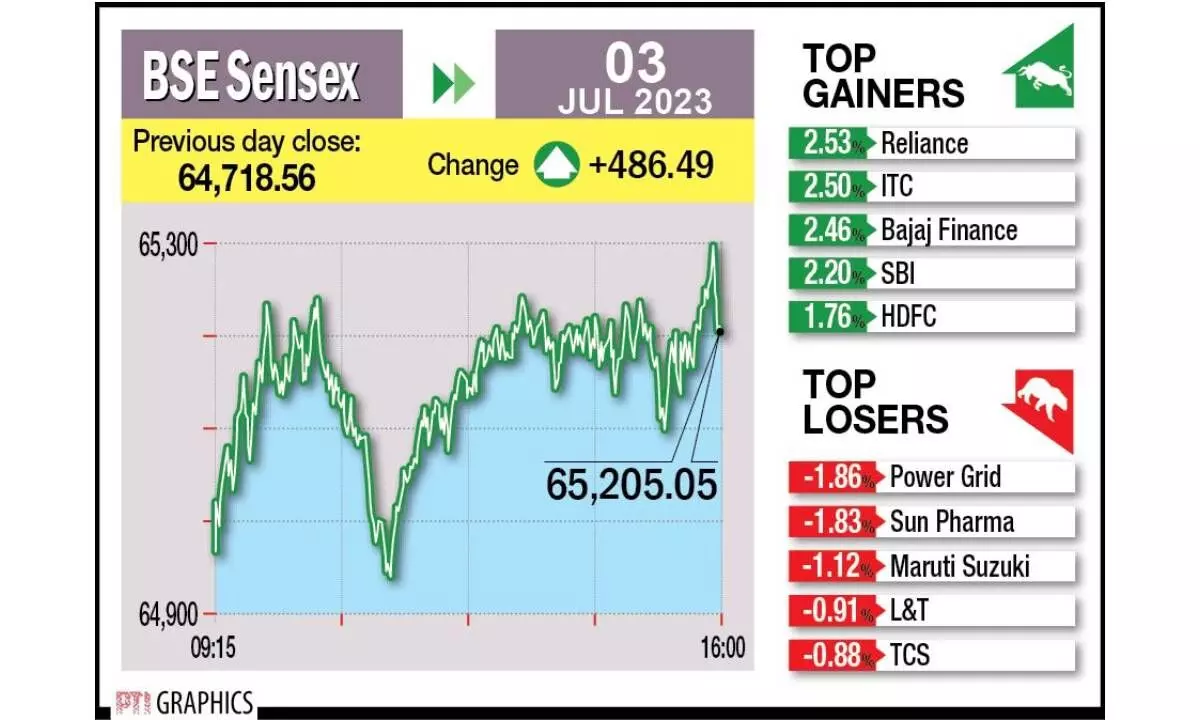

Sensex zooms past 65k

Bulls On A Roll: Nifty crosses 19,322pts; Key indices clock record highs for 3 sessions in a row; Hectic buying in RIL, ITC and HDFC twins further adds to mkt momentum

image for illustrative purpose

Mumbai Equity benchmarks Sensex and Nifty soared to fresh closing record highs for the third successive session on Monday, with the 30-share index crossing the historic 65,000 mark on strong foreign fund flows and a rally in global equities. Hectic buying in index majors Reliance Industries, ITC and HDFC twins also added to the momentum, traders said.

Rallying for the fourth straight session, the 30-share BSE Sensex jumped 486.49 points or 0.75 per cent to settle at its all-time closing high of 65,205.05. During the day, it rallied 581.79 points or 0.89 per cent to its lifetime intra-day high of 65,300.35. In a reflection of broader investor bullishness, the 50-share Nifty surged to a record high as sectors ranging from energy to financials to FMCG rallied. The Nifty climbed 133.50 points or 0.70 per cent to end at a record high of 19,322.55. In intra-day trade, the benchmark zoomed 156.05 points or 0.81 per cent to hit its all-time intra-day peak of 19,345.10.

Reliance Industries was the top gainer in the Sensex chart, rising 2.53 per cent, followed by ITC, Bajaj Finance, State Bank of India, HDFC, UltraTech Cement, NTPC, HDFC Bank, Mahindra & Mahindra, Tata Steel, Bajaj Finserv and ICICI Bank. In contrast, Power Grid, Maruti, Larsen & Toubro, Tata Consultancy Services, Tech Mahindra, Nestle and Tata Motors were among the laggards, skidding up to 1.86 per cent.

“The market’s record-breaking momentum continued as the robust June GST collections, and the monsoon covering most parts of the country in the last few days brought cheers to investors. The rally has been mostly due to strong foreign fund inflows and India performing well on most of the economic parameters could further strengthen the fund flows in the near term,” said Shrikant Chouhan, Head of Research (Retail), Kotak Securities Ltd.

As many as 1,972 stocks advanced while 1,721 declined and 147 remained unchanged on BSE. In the broader market, the BSE smallcap gauge climbed 0.56 per cent and the midcap index advanced 0.30 per cent.

Among the indices, oil & gas jumped 2.28 per cent, energy rallied 2.08 per cent, metal (1.11 per cent), FMCG (1.09 per cent), financial services (1.02 per cent), realty (0.85 per cent), commodities (0.81 per cent) and bankex (0.78 per cent). Capital goods, auto, IT, teck, power and industrials were among the laggards.

“Sentiments of investors are reinforced by positive domestic data and optimistic global cues. The global market was supported by resilient economic data, avoiding the possibility of a recession. India’s stock market trend was broad-based, owing to the outperformance from energy, financial, metal, and FMCG sectors,” said Vinod Nair, Head of Research at Geojit Financial Services.

Foreign Institutional Investors (FIIs) bought equities worth Rs 6,397.13 crore on Friday, according to exchange data. In Asian markets, Seoul, Tokyo, Shanghai and Hong Kong ended in the green.

“Due to robust profit growth potential and increased demand from domestic and global investors, Indian shares remain appealing despite high relative valuations. The premium over the historical average implies increased optimism about medium-term growth,” added Shantanu Bhargava, MD, Head of Discretionary Investment Services, Waterfield Advisors.